Discover more from A Blockchain VC

The Formula for Finding Product Market Fit

Any entrepreneur who has successfully built a startup painfully knows that their original idea of what the startup would do, who its customers would be, and how it is going to make money, were most likely wrong. Realizing which of these early assumptions are wrong and successfully being able to course correct, is most often the difference between success and failure for a startup.

Getting this right is referred to as finding “Product Market Fit”.

Recently I listened to a 20 Minute VC podcast interviewing Rahul Vohra, CEO and Founder of Superhuman. In that interview, Rahul described the process that Superhuman underwent in finding product market fit and to date, I am yet to hear a more coherent and formulaic approach to doing so. So much so that I turned that interview into a 1-hour case study presentation to be taught as a masterclass in the Techstars accelerator. It’s a formula that I think other startups should learn from, replicate and make their own.

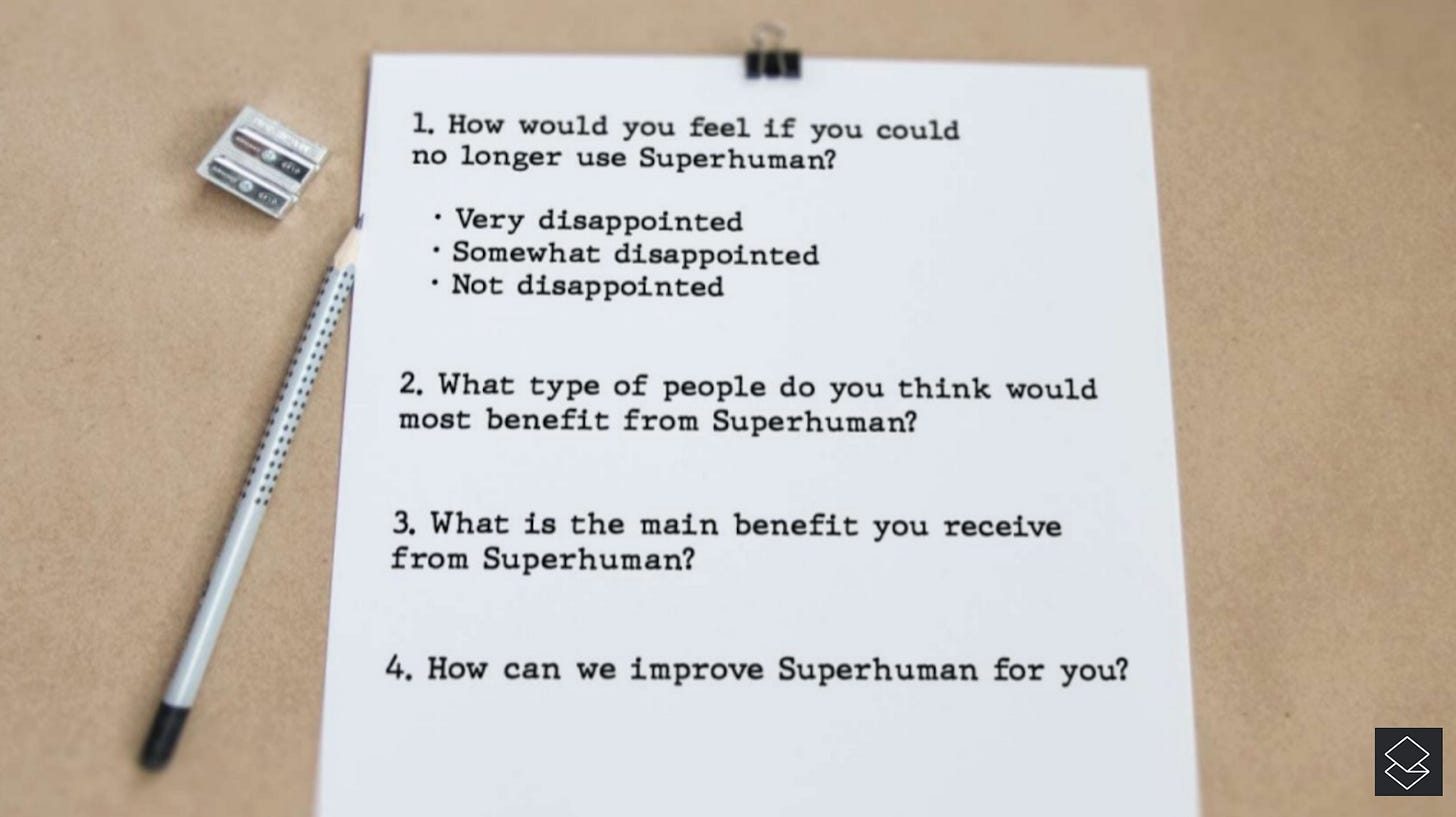

In this post, I’m going to outline how Superhuman used a simple four question survey became the basis of their entire product market fit process, as well as how they used the answers from that survey to build a repeatable product management plan that resulted in them finding product market fit and becoming a breakaway success.

I’ve also shared my presentation that breaks down these steps further, and strongly recommend that you give the original podcast interview a listen to and use the additional material that I link to in the footnotes as well.

Before we get started, here’s the simple four question Superhuman survey:

Now let’s get at it !

Step 1: Rallying around the Product Market Fit KPI - PMF%

Most definitions today about product market fit are qualitative. They describe how a startup should look and feel once they’ve achieved product market fit. They are in essence, post fact and unfortunately unhelpful for any entrepreneur who isn’t there yet. As the saying goes, “you can’t manage what you can’t measure”, so the first step is defining a leading indicator that can be used as your product market fit score. This indicator becomes the single rallying metric that the entire organization works towards improving.

Rahul credits Sean Ellis (the original growth hacker) for his work at DropBox, Eventbrite, LogMeIn and other well known startups. Known back then as the ‘Sean Ellis Test’. The test is one simple question.

How would you feel if you could no longer use the product?

Not disappointed

Somewhat disappointed

Very disappointed

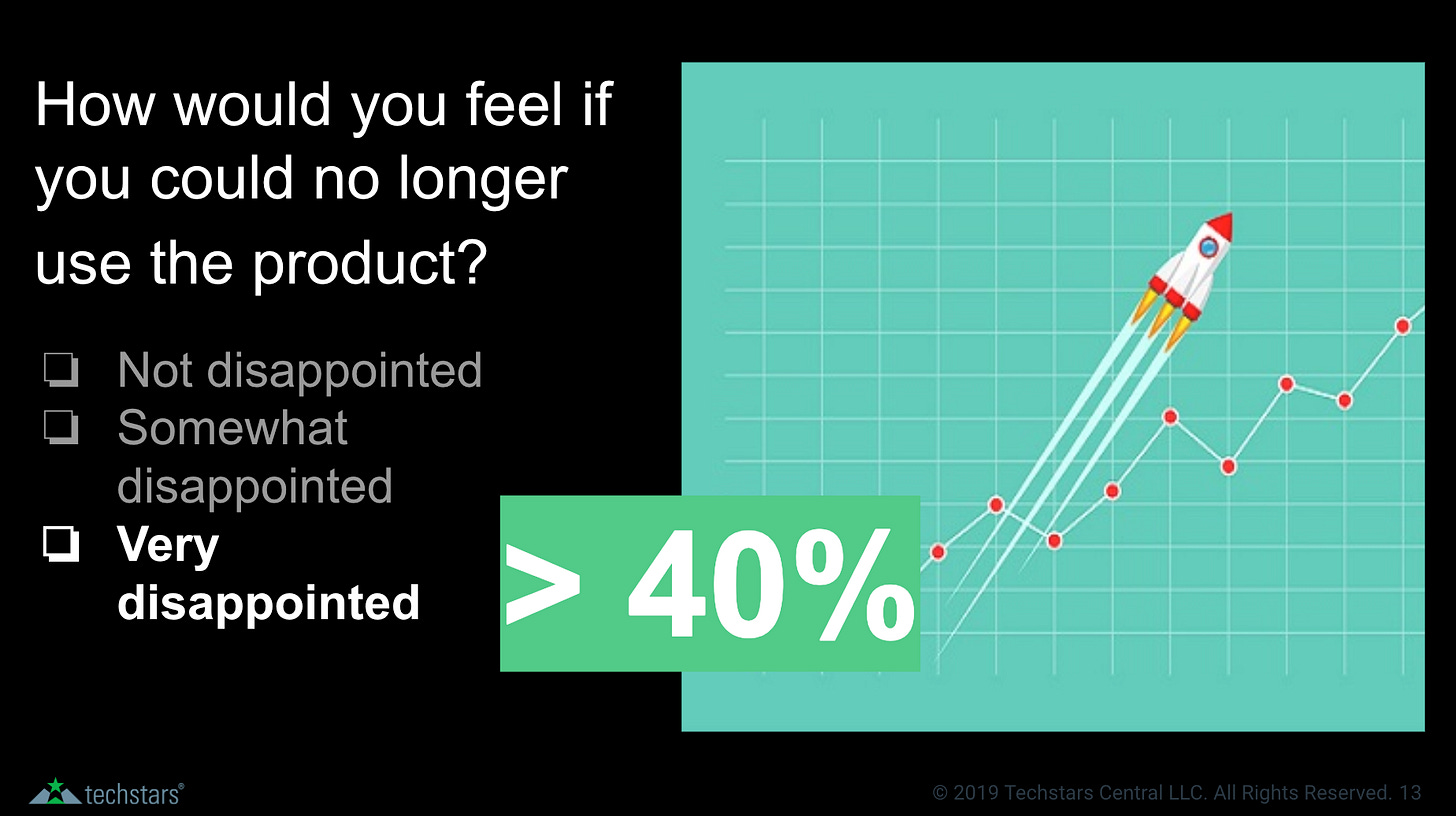

What Sean realized is that companies that were able to score 40% or more in ‘very disappointed’ responses showed much stronger growth rates than their counterparts who scored lower on this metric and were the companies that ultimately succeeded. Ultimately defining the point where product market fit has been achieved.

This becomes your product market fit (PMF) score. The % of customers who would be very disappointed if your product or service no longer existed.

According to Sean Ellis, people who should take the test should have certain qualifications:

People who experienced the core product or the service

People who have experienced the product or the service at least twice

People who have experienced the product or the service in the last two weeks.

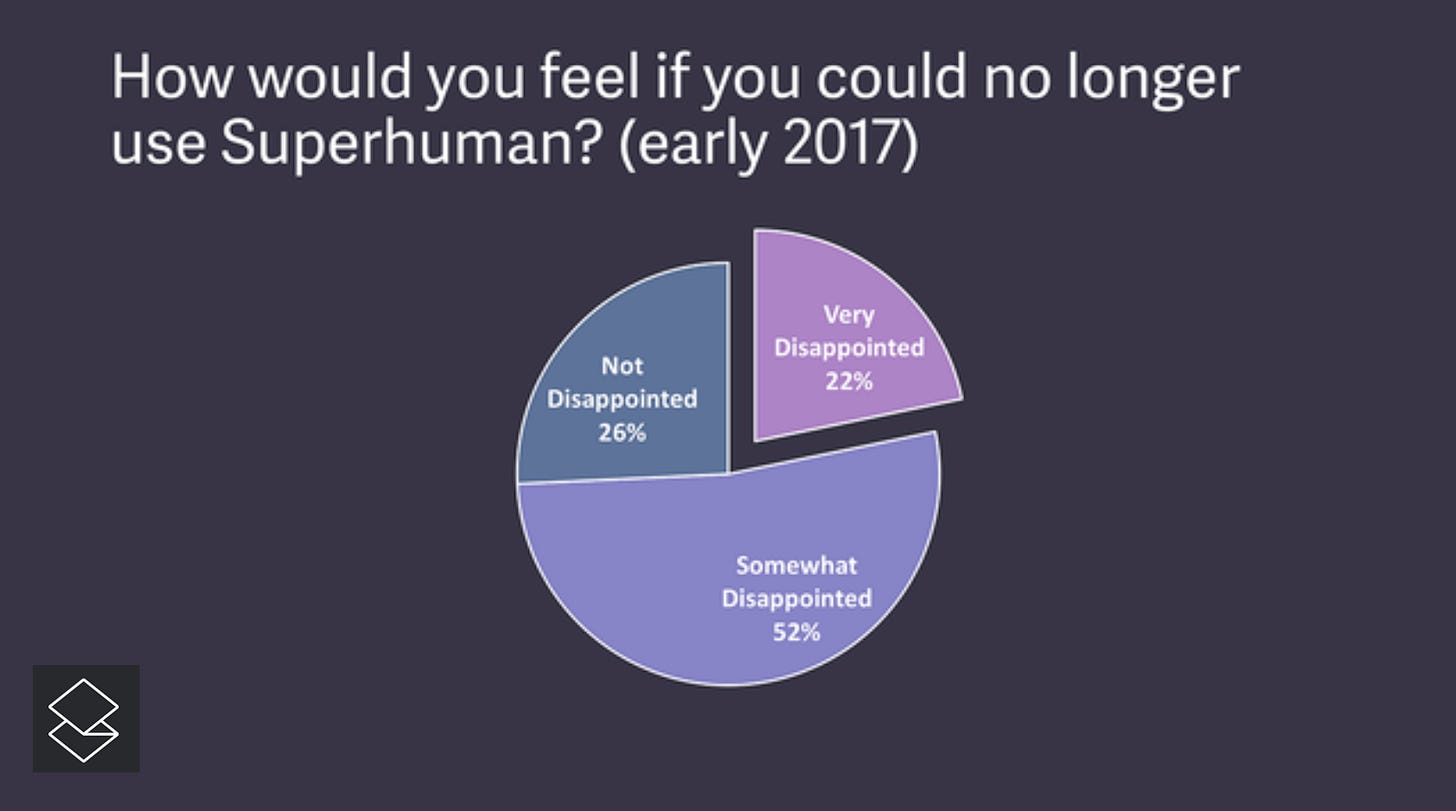

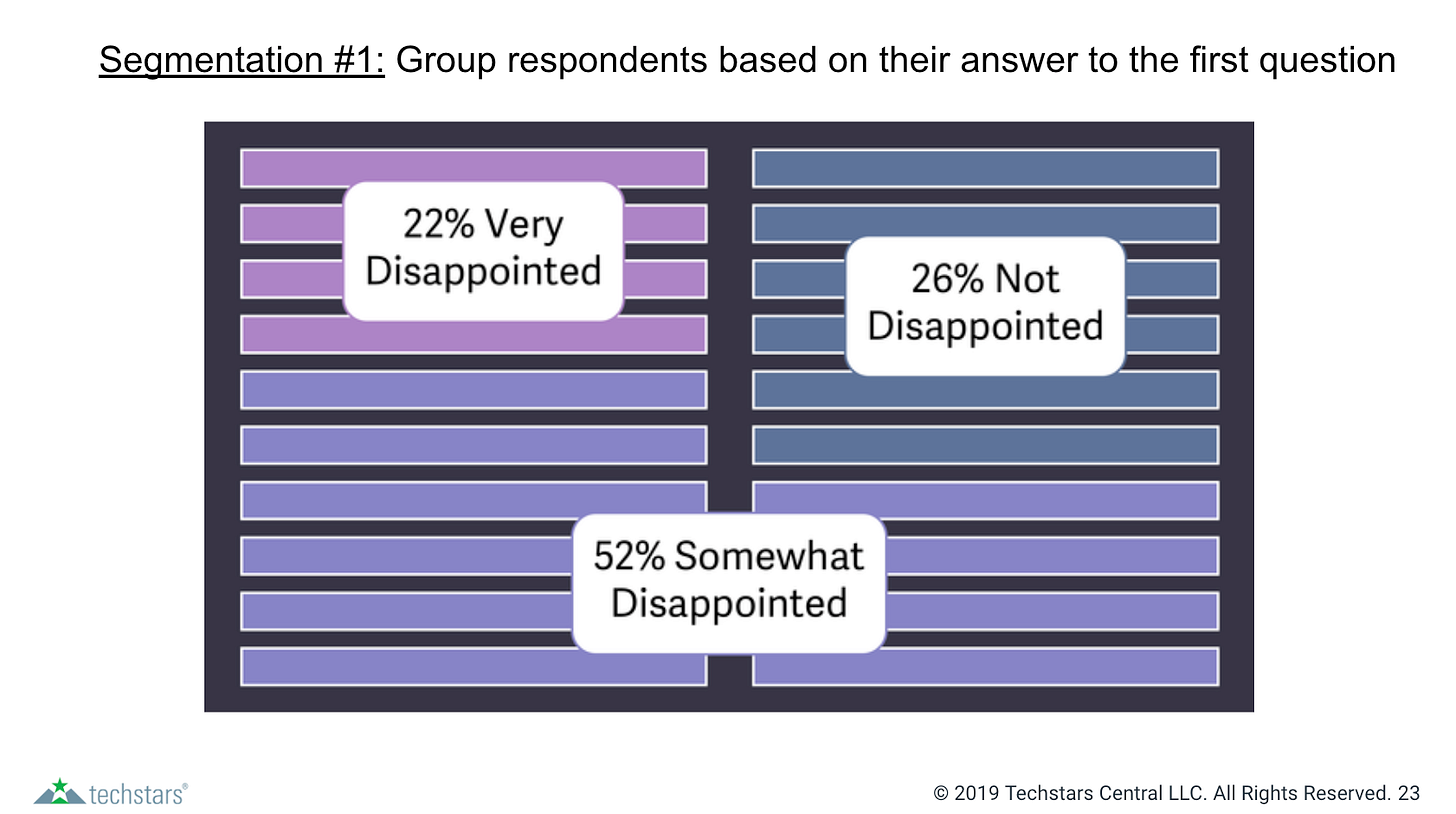

For Superhuman, after spending 2 years developing the product and finally releasing it to the market, customers responded with a 22% PMF score (22% of respondents would be very disappointed if Superhuman no longer existed; 52% somewhat disappointed; 26% not disappointed). This result is well below the targeted 40% required, and as Rahul describes it, a heartbreaking result to receive, but at least giving a baseline for the company to now focus on and a target to work towards.

But how to improve the PMF score?

Step 2: Segmenting your clients / users

The second step involves getting smarter about how you segment your user base. For this, Rahul borrows from Julie Supan and her work in creating the High Expectation Customer (HXC) Framework for companies like Airbnb, DropBox and Thumbtack.

According to this framework, your High Expectation Customer (HXC) is the most discerning person within your target demographic. They will enjoy your product for its greatest benefit, they will spread the word and others will aspire to emulate them because they seem inspired, clever and insightful.

Some examples of HXC’s from other companies are:

Dropbox - Dropbox high-expectation customer is actually a person who wants to simplify his or her life. They're trusting, organized, tech-savvy, and looking for ways to get some time back in their day. They want to know they're covered, that someone has their back when it comes to their life's work, which is primarily in their computers—family photos, videos, work files, school docs.

Airbnb - This HXC is invested in being a good global citizen, and doesn’t want to simply visit new places but to belong. It’s the guest who wants to ‘live like a local’ and experience Paris as if they are living there. They’re energized by the idea of staying in unique spaces and feeling welcomed, but are cost-conscious, too.

So how do you find out who your HXC is? For this, you use the second question in the four part survey: What type of people do you think would most benefit from product/service?

How does this question give you an idea of who your HXC might be? In answering this question, users who love your product are actually describing themselves. They are telling you who they are, in their own language.

It’s important here to first segment your responses and group them based on how they answered the first question (i.e. How would you feel if this product no longer existed?). Essentially, creating three buckets of responses. Those that responded “Very disappointed”, “Somewhat disappointed”, “Not disappointed”.

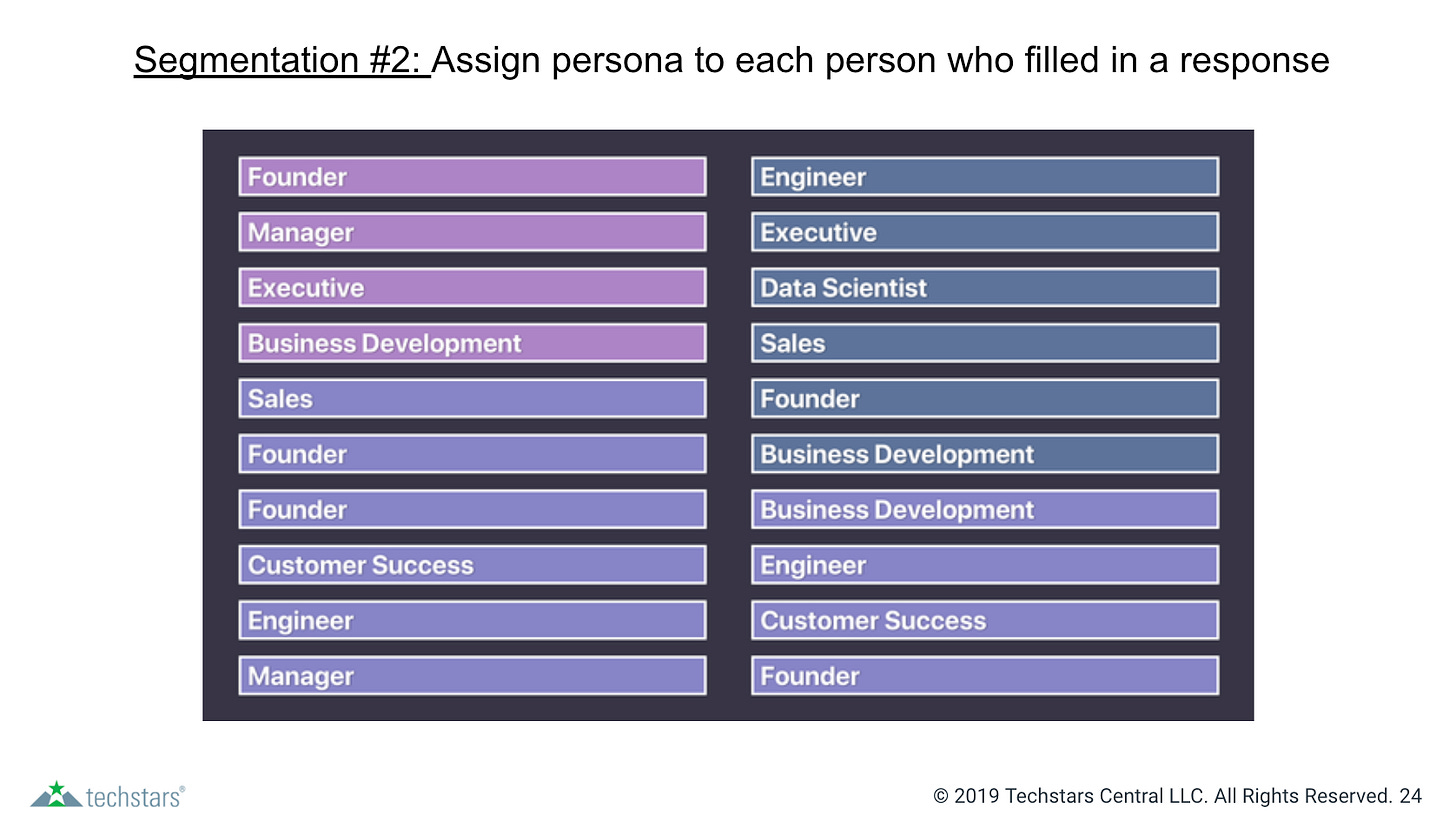

Once grouped, you then take each individual response and assign a persona to the response.

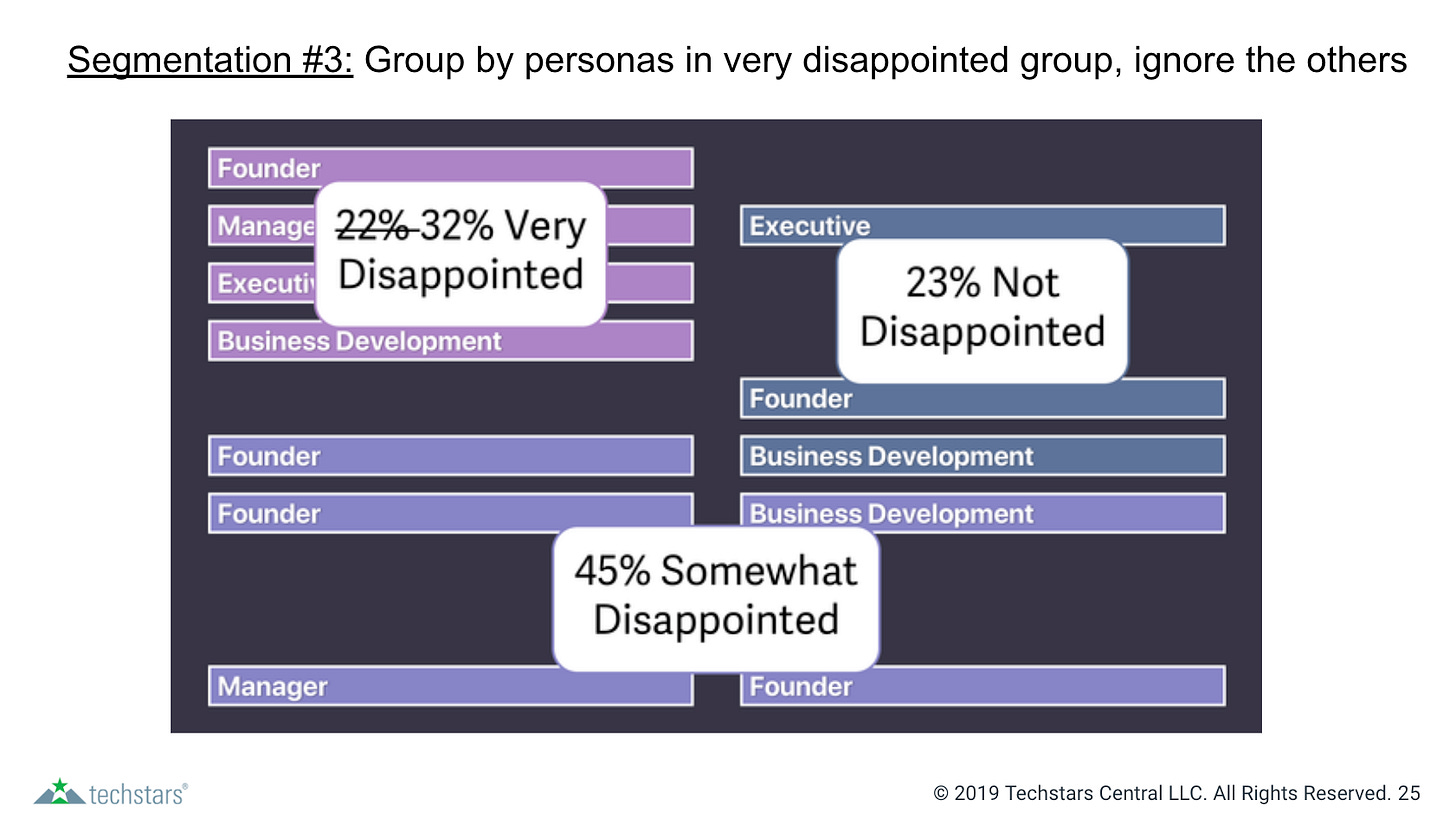

Lastly, to define your HXC, you group the personas in the “very disappointed” group and IGNORE the rest. This is a painful step for most CEOs but entirely necessary. Remember, you’re defining your highest expectation customer here. This is the person who would VERY DISAPPOINTED if your product no longer exists so it’s essential that you only group for this persona.

Doing so will give you enough information to then get a pretty clear picture of who your HXC is and also should result in an improvement in your Product Market Fit (PMF%) score.

In Superhuman’s case, they saw their score grow from 22% to 32%! Still below the 40% desired state but a move in the right direction. At the end of this segmentation, Superhuman were able to define who their HXC is.. they call her Nicole.

Nicole is a Hardworking professional. Works with many people. Might be an executive, founder, business manager. She feels she is very busy and wishes she had more time. Spends a lot of her day in her inbox. Will read up to 200 emails. Send 50 to 100 emails. Feels it is part of her job to be responsive. Prides herself in that. Nicole has a growth mindset. May have a fixed mindset about email.. she is skeptical that a new email client will make her go faster.

Step 3: Get clear about why your biggest fans (your HXC’s) love your product

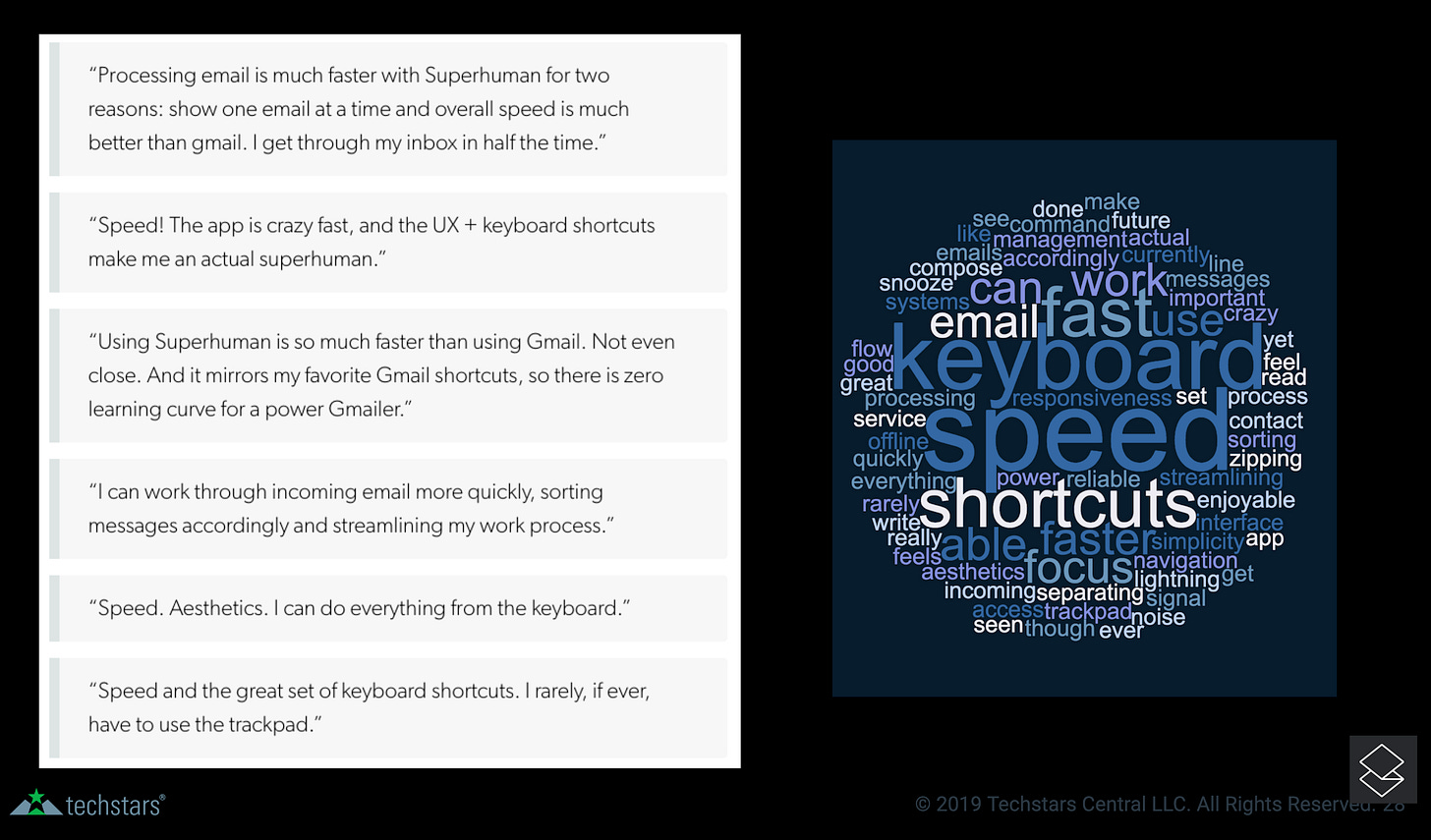

This is where the third question in the survey: what is the main benefit that you receive from Superhuman, comes handy. To get clear about the main benefit that your product delivers, remember again to only focus on the respondents who you’ve already segmented in step 2 (Those that answered “very disappointed” to question 1 and who fit your HXC persona).

Once you’ve collated all of those responses, Rahul recommends throwing all of the answers into a word cloud and you should immediately get a sense of why people love your product.

In Superhuman’s case, you can see that SPEED stands out as the main benefit that people love. Followed by keyboard shortcuts, then ability to focus and so on. This feedback should then be used to inform your marketing copy. There’s no need for expensive brand consultants or marketing agencies to figure out your positioning, your biggest fans are writing it here for you!

Ok, so you might be asking yourself at this point: “Great Yossi.. I’m 10 minutes into reading this blog post and you’ve shown me how to figure out who loves my product and why.. but how do I actually increase my product market fit score further? How do I get the customers sitting on the fence to become fans? How do I get to that magical 40%?”

I’m glad you asked.. that brings us to step 4.

Step 4: Segment again!

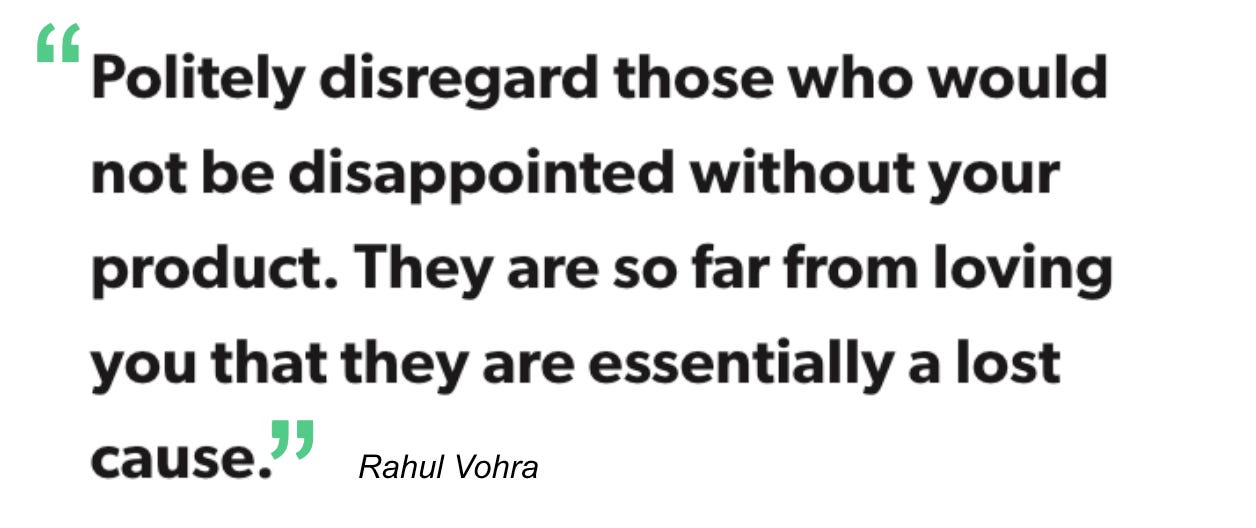

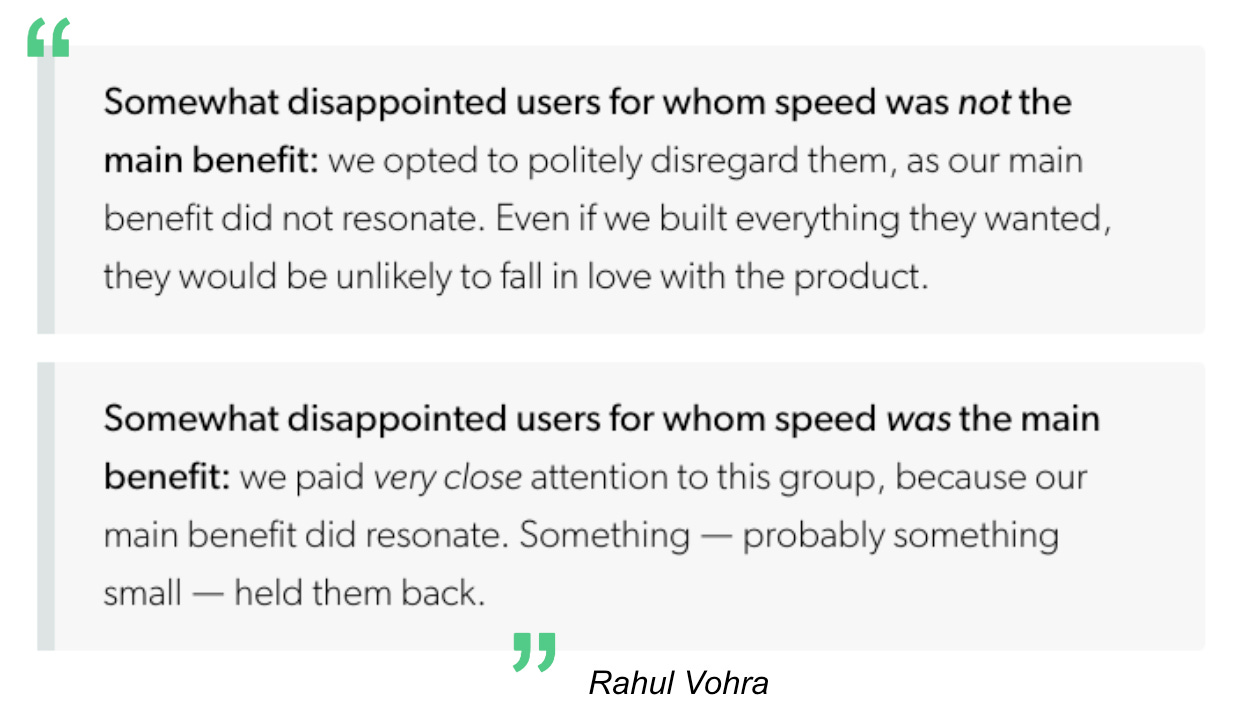

Here Rahul recommends something that is most likely counterintuitive to most: you should completely disregard any of the feedback from people who answered “Not Disappointed” in question 1 of the survey.

And only focus on those that answered that they were “Somewhat Disappointed” but for who they listed speed as the main benefit.

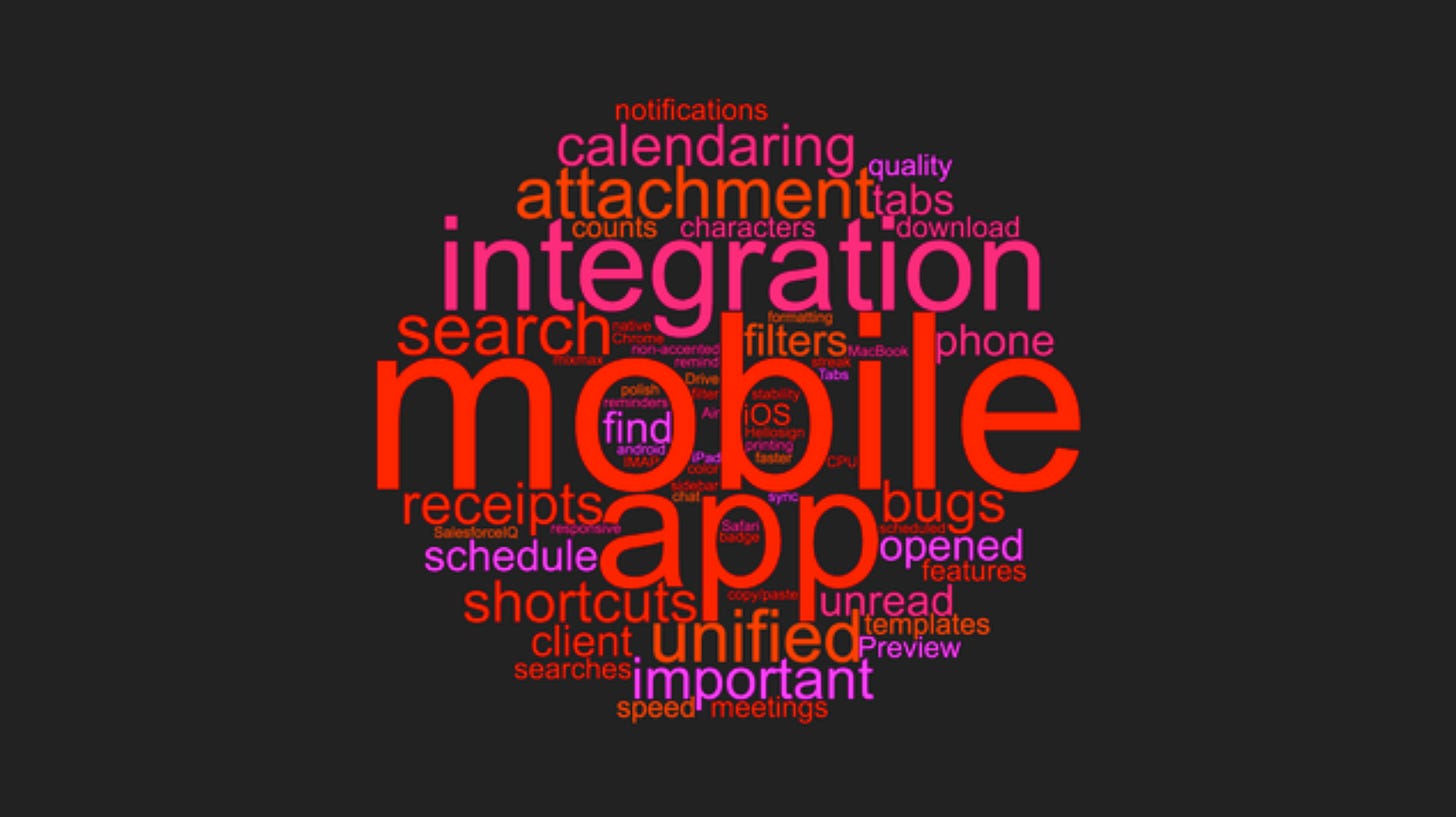

And then you turn to the last question in the survey: How can we improve superhuman for you? The answer to this question tells you what may be holding users back.

In this example, we can clearly see that the main thing holding Superhuman users back is a mobile app (then better integrations, calendaring, and so on).

To increase your product / market fit score (PMF%), the recommendation from here is to spend half of your development time on what people love and the other half on addressing what’s holding others back. This effectively becomes your product development roadmap.

Why this strategy?

If you only focus on improving the features that people already love, your product market fit score won’t improve. If you only focus on what is holding your product back, your competition will most likely overtake you.

In Superhuman’s case, this is how that product roadmap looked.

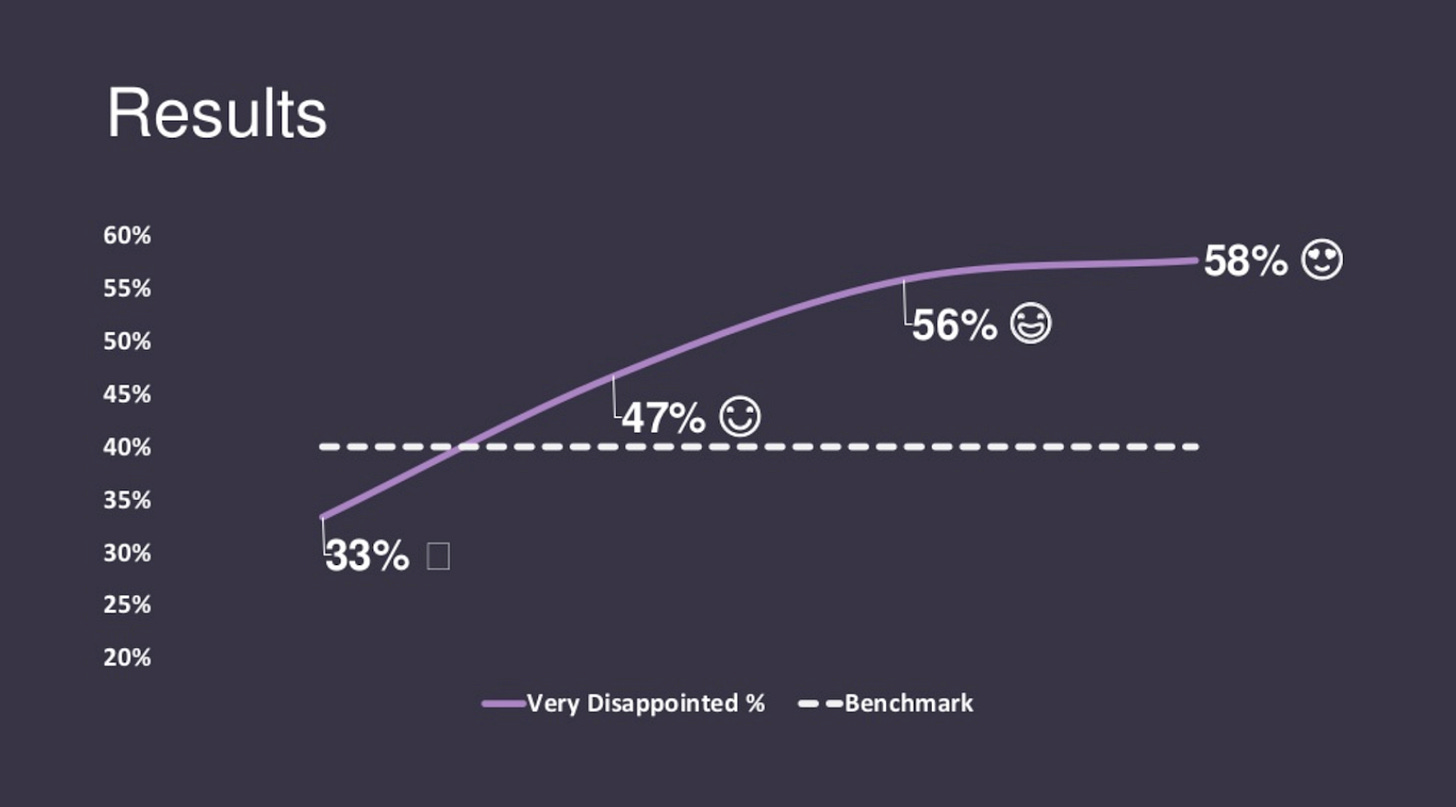

And this is how their PMF% score has tracked (clearly, the strategy is working).

Now I know that the above feels like quite a lot but I assure you it’s quite an easy process to follow. It’s effectively 6 easy steps, so keep calm and let’s recap:

Here are some additional resources that you can also use to learn more about each step:

Subscribe to A Blockchain VC

The trials and triumphs of building a more open internet and financial system through decentralized technology. Thoughts on blockchain, venture, living in New York and betting on the future.